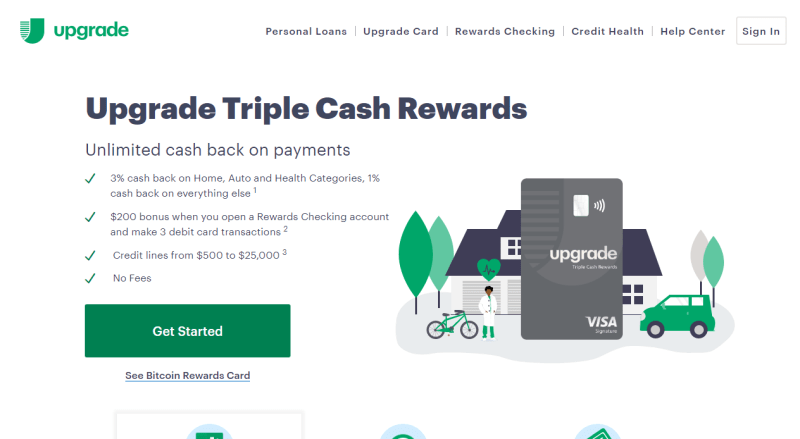

Is Upgrade Loans Legit – This is not your ordinary credit card. This credit card can be used anywhere Visa is accepted. What you need to know is to use it based on your line of credit and your business and pay accordingly. Please read the text carefully before using/applying. The application process is hassle-free and quick.

I know there are a lot of great reviews here saying it’s a good card to get and use. I will disagree that the application process is easy, it’s easy to buy, you have a high credit rating, and they have an app that allows you to pay extra if needed. The issue comes when you try to pay immediately. You are not allowed to make final payments on their app or website, they call you customer service. It is very difficult for agents to find out how much you owe for your last payment and will be held up for 30-40 minutes while they calculate this. I had to try to get the account balance to $0 after paying 3 times in the last 2 weeks. I received excuses from various agents as to why the bill did not show a balance even though I made 3 separate payments for the total amount owed on the days I called. Additional interest is the most common excuse given to me because they don’t seem to send payments immediately but within 24-48 business hours. The third agent I spoke to said they would waive the interest for me after the last payment so the account balance would end up at $0. He assured that it would be considered paid. I signed up a few days later, but it wasn’t even $0. I understand that this is only talking about a few dollars per payment after the first payment, but it is very annoying when I want to pay. I now have to call 2 more times because the balance is not at $0 and the last 2 times I asked for a supervisor. I have called 5 times just to make the final payment, which is ridiculous. Agents will tell you that a supervisor will call you back in a few hours because you have been placed on a callback list. It’s been a few days and I’m still waiting for it to come back. This card is going down the drain and I don’t think I will ever use it again due to the frustration of just trying to pay quickly and not getting a decent amount of time from the supervisors on the matter.

Is Upgrade Loans Legit

This company is horrible! Much interest. Scottish foreigner. It takes up to 2 weeks for payments to appear on your card after they withdraw the money from your bank. I would never recommend this company.

Upstart Vs Upgrade: Which Personal Loan Is Best For Your Needs?

The application process was very easy and I understand that this credit can be used as a credit card. I will use it for big purchases and will be careful.

:max_bytes(150000):strip_icc()/Truist_Recirc-801d11668f2b40d2b72a3f42c5e51a62.jpg?strip=all)

I applied for this loan, even though they said “See if you are good in minutes without affecting your score” I still got a -5 on my score. Be aware that if you use it, your score will be affected.

It’s easy to get a great line of credit but their customer service is terrible and their decision making team is even worse! It took two months to renew my phone number and my card has been duplicated in three months. The first time it was from fraud and they sent me a new card. The second time was when I tried to call in and update my phone number from my new phone after entering my credit card number. They approved my account right away. As I said, it took them two months to update my phone number and reactivate my card after submitting about 10 different types of documents to verify my address with my new phone number, including not only PDFs of my phone bill , PDFs of the front page with my address and full name as well as official documents such as a copy of my driver’s license and passport photo page. They reactivated my card after verifying my documents over the phone. A few days later I tried to use my card and they blocked it again and it won’t work again. There seems to be no communication between the internal teams. I also have to say that every time I call Lynn I put her on hold for at least 45 minutes. One day I was on the phone with them for six hours and it was written. The last team is a nightmare at best!

Best Loans For Bad Credit Of 2022

This company does not care about the customer. DO NOT GET THIS CARD. They will lower your credit score whenever they want. No missing/late payments either. Big mistake getting this card. No concessions and limited hardship assistance.

To make a payment other than the minimum payment you must call every month, you cannot make special payments other than the minimum, I have many credit cards, but none of them like this.

/images/2020/01/15/couple-doing-home-improvement.jpg?strip=all)

This card is very bad. Paid in full then told me I owe 0.05 or 0.02 and it’s too late I’m sure there will be a class action lawsuit soon.

Upgrade Loans Review 2022: How It Works

Do not choose this card or sample card, customer service is very unprofessional and many of their credit cards are disguised as credit cards. They will bite you when you least expect it. Just be careful and read the reviews together!

I used the car twice and paid off my loan in 2 months. After I used it the third time, they reduced my debt from 4,000 to 1,300. I was never late on the last two loans and paid quickly.

We calculate your chances of approval based on your credit history. Sign up today – it’s free! You will also find:

Universal Credit Services Personal Loans Review December 2022

These ratings and reviews are provided by our users. Banks, publishing companies, and credit card companies do not endorse, approve, are not responsible for, and may not be aware of this content.

†† The opinions you read come from our editorial team. Credit Karma receives rewards from third-party advertisers, but that doesn’t influence our editors’ opinions. Our advertising partners do not review, approve or endorse our advertising campaigns. It is correct to the best of our knowledge at the time of publication. Editor’s Note: Lantern by SoFi strives to provide objective, independent and accurate content. Authors are separate from our business and do not receive direct compensation from advertisers or partners. Read more about our affiliate program and how to make money.

For some people, unpaid balances on multiple credit cards prevent them from easily paying off existing debt. For individuals with different interest rates on different cards, it can be difficult to keep track of and pay back more than the minimum amount due each month.

Sofi Personal Loans Reviews: Compare Top Lenders Of 2022

Improvements that offer credit consolidation loans can help borrowers get approval to move their debt to one month with an APR. Renew also provides online unsecured loans for other purposes – including major purchases or home improvements. Here is an overview of getting a loan online through Upgrade:

While you’re researching loan reviews, be sure to research other lenders to find the best match and rate for your financial needs.

Most of the reforms are aimed at offering debt consolidation loans or loans to refinance existing high-interest debt. But you can also use a loan to improve your home, expand your business or make a major purchase.

Upgrade Card Review: Charge Like A Credit Card, Pay Off Like A Loan

Renew also offers a line of credit that comes with a Visa card. Borrowers can use it like a credit card or credit card and repay the amount of the line of credit they use.

Consolidation can be one of the advantages of online loans for applicants with good credit, but personal loan interest rates for those with poor credit can be higher than other online loans. For qualified borrowers who are paying high interest on multiple credit card balances, an online personal loan update can be one way to secure that, have credit in one low-cost payment.

Borrowers may want to check what rate they may be eligible for the upgrade first and then compare the loan offer with current interest rates.

Lendingpoint Personal Loans Review

Upgrades may not offer the best prices out there, depending on your qualifications. The highest APR is around 36%, which is higher than most credit cards.

Applying for a personal loan is quick and easy. For those who meet the criteria, the turnaround time for full application approval is usually within four business days. It can be money

Is personal loans legit, is loans legit, is fiona loans legit, is citrus loans legit, is quicken loans legit, are upgrade loans legit, is sofi loans legit, is loans canada legit, is credible loans legit, is bhg loans legit, is upgrade personal loans legit, is upstart loans legit