Kim Kiyosaki Age – Your Real Property is a step-by-step online guide that helps homeowners and investors buy the right property at the right price. Check out more.

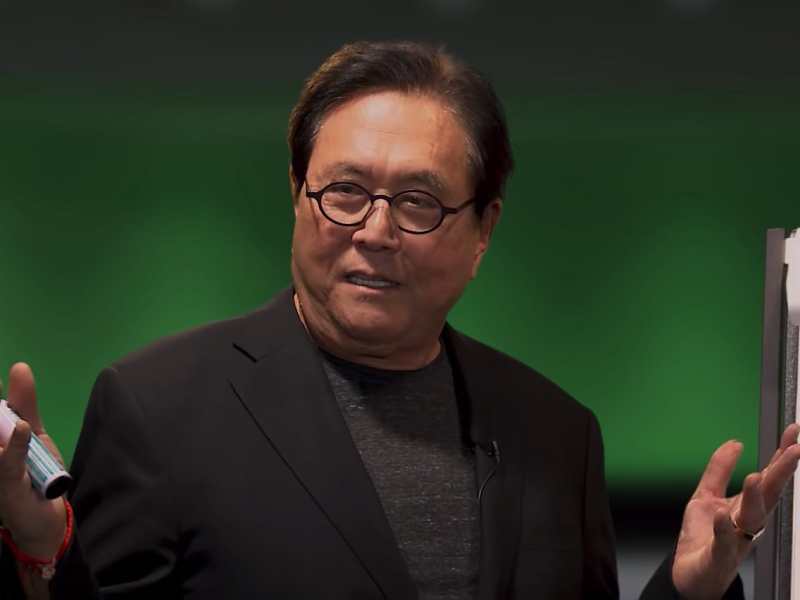

Today’s special guest is none other than author, speaker and co-founder of the company ‘Rich Dad’, Kim Kiyosaki!Kim has something important to say about taking responsibility for our own actions. money… Rich dad poor dad by washing cars!

Kim Kiyosaki Age

Are you going to work hard for your money all your life or do you want your money to work for you? – Kim Kiyosaki’s wealth is determined by how, if you don’t work today how long can you survive financially on your current lifestyle? – Kim Kiyosaki Money can be very controlling so I am all about women to take care of their money. I’m all about women taking control of their lives. – Kim Kiyosaki

Rich Dad’s Kim Kiyosaki Shares The 2 Things Every Woman Needs To Know About Money

John Blackman: Did you know that with just two investments and one renovation you can put over a million dollars in the bank? It is true and why stop? Welcome to Your Real Estate Podcast, a show that explores practical steps to making your real estate dreams come true.

Which my mother repeated every morning but we were away from Sydney from Dubbo for a week and someone put it on and on Dubbo radio, all these people were shouting, “There’s a the cockatoo in my front tree goes, ‘Jane, Wake up! Wake up! Thank you!'” So, of course, within 24 hours, Fred was famous all over Dubbo as well. So here you go, true story.

John: This is interesting because I have a friend, Craig, who has a cockatoo that used to say, “Hey, Craig” because his mother would come and call him for dinner. So when we wanted to call Craig, all the kids would go, “Hey, Craig.”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/OTWJDGNN2NKLWMPZ2TVCXTCRFA.jpg?strip=all)

The Story Of Rich Dad

Jane: I like it. I like cockatoos. Well guys, welcome to Your Product Success Podcast Episode 12 and John I think we’ve outdone ourselves this time. We have a great guest, author, speaker, teacher and inspiration for women around the world, Kim Kiyosaki.

Jane: Of course, the first one in my library already. It’s an honor and I’m going to ask him a lot of things, you know, Robert and how he started

![]()

From the car wash. Take care of that. That is a story in itself and because many people do not know that they are the creators themselves before the book and that the book is a product of something else. And for the women out there and the men who love them, you don’t want to miss this because Kim has a lot to say about being responsible for our personal finances. She talks about how many women can make money without knowing it and why women now need to take control of their own finances. And we also talk about how everyone, men and women, can start investing today. So, settle in for what I’m sure will be a great episode with today’s special guest, Kim Kiyosaki.

Kim Kiyosaki Biography: Children, Net Worth, Books, Marriage

Jane: Hi Kim and welcome to your Good Stuff Podcast. Now, you have been very successful in terms of investment and business but I want to start a little about where you are and what came before all this success?

Kim Kiyosaki: That’s a good question, Jane. First of all, thank you in your program and congratulations, you have done a great service in teaching people and this is really my love My background, I mean, I grew up outside of New York City, moved to Oregon, to the west and up to Hawaii. But I love business. I am very competitive. I’m always competitive, I love sports and I love sports. And I remember in college at the University of Hawaii, I went there for two or four years, I remember sitting down choosing a major and I went through all the names and I was like, “I don’t know I don’t know. Where I want.” And then, I came to business, And I was like, “Business is a game.” I like to play, so I choose business and I always like to do business, I always like to do business. .So, when I got my first job out of college with an advertising agency, I was in the newsroom, just graduated it was the entrance but my manager and I not received. he quit completely and after 9 months, the same day i quit, he fired me.

Kim: Yeah and he said, “Well, if I kill you, you get two weeks free.” I said, “I’m fired.” Done. That’s the best thing that can happen to me because the result, I see, and I know many women relate to this, I hate to say what I’m going to do. I hate it. And I knew I had a problem, so I had a few jobs, mostly sales, but I always knew I wanted my own business. That’s the goal. When I look back in my heart, what is most important to me, and I want you to ask yourself, what is most important to you in your heart , not one of your own. Many women say, “Oh, my children are the most intelligent.” But, if there is no child, if there is no husband, if there is no job, what does it mean? And for me, freedom is the most important thing in my life. I want to be independent and it plays out in many different ways. It’s like I’m an entrepreneur starting my own business. It plays as free money and is not tied to my job or tied to a spouse or family. I think a lot of us women – one question I would ask you audience is, what were you taught about money in school?

Things Robert Kiyosaki Says You Should Do With Your Money In 2015

Jane: And many of us were not taught about money in school. That financial knowledge is missing from the education system.

Kim: Yes, yes. Directly, directly. And I ask many women what do we teach you about money and many of us are taught to depend on other than men, a family, all of that.

Jane: There are some terrible reviews around, aren’t there? I think you have some stats from America about the fact that –

Rich Woman Audiobook By Kim Kiyosaki

Kim: Yes. They are American data but the pattern may be the same as Australia, it may be the same in England and the big countries but the stats say that 50% of marriages today end in divorce and it it is women who often end up with children. And interestingly, the first year after the divorce, the woman’s standard of living drops, I think, about 73% when she goes up because she has children and maybe she hasn’t worked for all this . However, I think that the most vulnerable are the elderly who live in poverty, three out of four are women, but that is not dangerous. The scary thing is that 80% of people who live in poverty, 80% of these women are not poor when their husbands are still alive.

Jane: And I gather, obviously, that may be taking care of their husbands when they’re sick and their husbands may be getting older and dying sooner –

Kim: Yeah, that’s a good point Jane because the couple’s finances, their nest egg, lost a lot of money because of illness, at the end of their lives. Therefore, if he dies, he will be less, he will not know what to do with him and Mr. and Mrs. Helper will come, and he will say, “Oh, I can help you.” And the next thing you know, it’s broken.

Robert Kiyosaki’s Ongoing Legal Dispute Says Everything About The Shadiness Of Personal Finance Gurus

Jane: He didn’t get anything. I believe these statistics will help you spread the word and help women empower themselves in terms of financial security. But I understand from reading your book that there was a time when you were 14 years old that you went into a conversation with your mother and a friend of hers that changed your behavior. Can you tell us about that?

Kim: Yes. When I was young, I guess it goes back to the question of how many women buy money and I’ll get into that in a minute. The story goes that I was in my house with my mother and I was walking and they were talking, her and her boyfriend, and they were probably in their 40’s at the time, and my mother said, “Come in go. kitchen, I need to talk to me